north carolina estate tax id

Apply for a license online. North Carolina Department of Revenue.

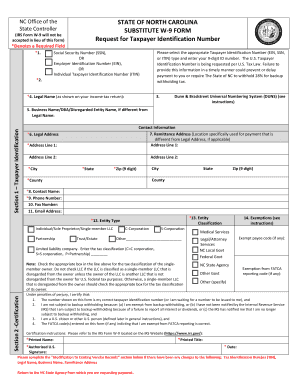

Nc State W 9 Form Fill Online Printable Fillable Blank Pdffiller

1301 Mail Service Center.

. Pay Online Click Here - You may pay online with a Credit Card Debit Card or Check. Submit a Report Submit a Payment Upload Holder Documentation Upload Finder Documentation - Tax ID. North Carolina Department of Administration.

The federal gift tax has an annual exemption of. 1200 pm-130 pm Network. However the rate is.

1030 am 1200 pm North Carolina Department of State Treasurer Presenter. How to Pay Your Taxes. North Carolina Income Tax Range.

Create a Business Online. North Carolina Department of Revenue. Property Tax Collections Past Due Taxes Business Registration Information for Tax Professionals.

How can we make this page better for you. Apply for an Exemption. The mission of the Harnett County Tax Department is to provide fair and equitable appraisal assessment billing and collection of taxes on real business and personal property.

North Carolina Income Taxes. To complete the online application for a North Carolina Tax ID EIN the following information will be required. Listed below are the ways to pay your Haywood County taxes.

PO Box 25000 Raleigh NC 27640. FIND YOUR UNCLAIMED PROPERTY NOW. Welcome to Macon County North Carolinas Tax Administrator Website.

Property Tax Collections Past Due Taxes Business Registration Information for Tax Professionals. Once your application has been submitted our agents will begin on your behalf. State Property for Sale Property Search.

North Carolina Secretary of State Business Registration Get a Federal and State Tax Id Number. Obtain your Tax ID in North Carolina by selecting the appropriate entity or business type from the list below. The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the counties and.

The responsible partys legal name an individual who will be responsible for communication regarding tax matters and their social security number. Folwell CPA State Treasurer of North Carolina Location. They will have identification and will be wearing clothing with Macon County tax office identification.

Full Legal Name as is or will be registered in North Carolina. For 2021 North Carolina has a flat rate of 525 of state taxable income. Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and taxation of property.

It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act. File online expense report. PO Box 25000 Raleigh NC 27640.

The Ultimate Guide To North Carolina Real Estate Taxes

North Carolina Estate Tax Everything You Need To Know Smartasset

How To Obtain A Tax Id Number For An Estate With Pictures

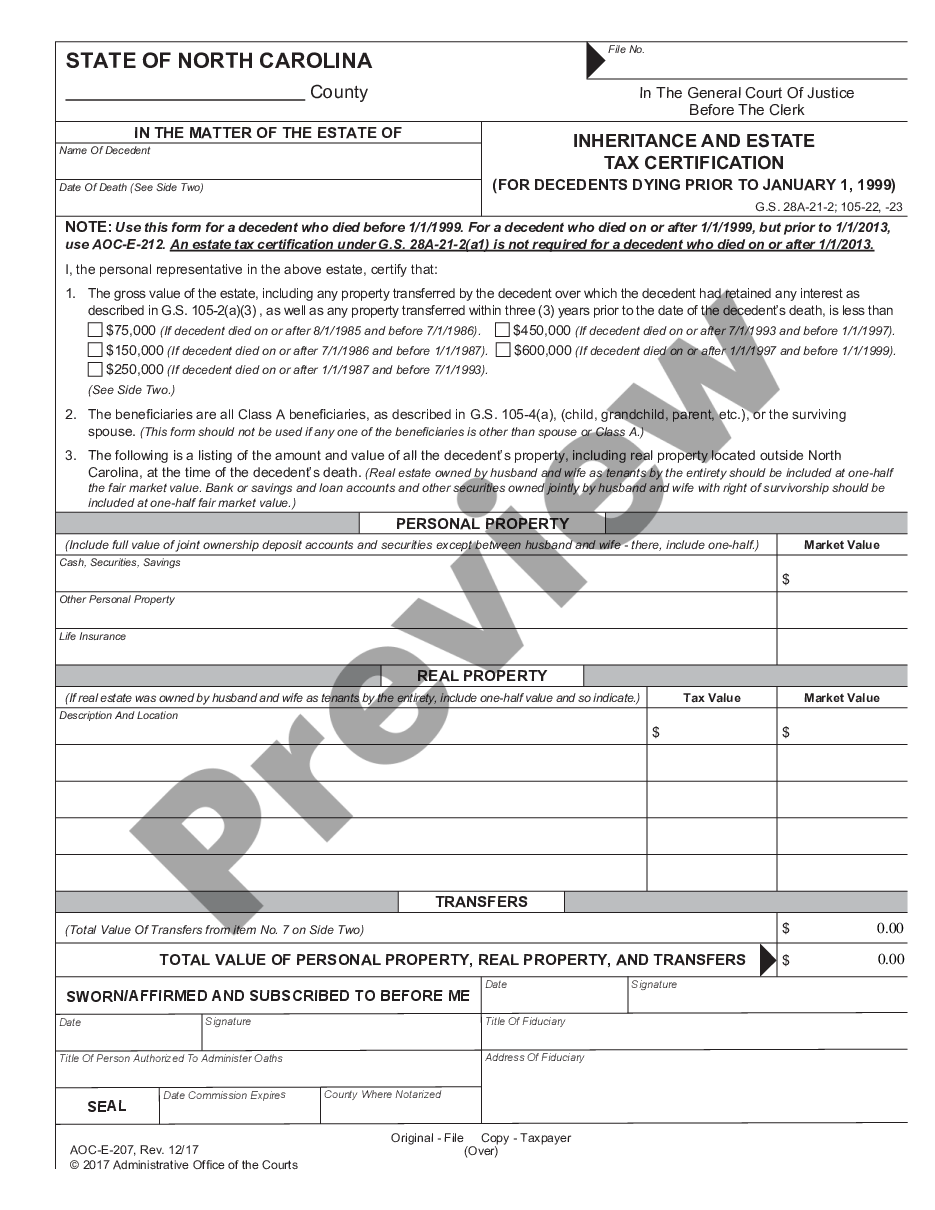

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Complete Guide To Probate In North Carolina

Tax Department Macon County North Carolina Macon Nc Government

Tax Lists Bladen County 1784 Tax Lists And Records North Carolina Digital Collections

How To Obtain A Tax Id Number For An Estate With Pictures

Form A 101 Estate Tax Return Web Fill In

How To Obtain A Tax Id Number For An Estate With Pictures

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Free North Carolina Name Change Forms How To Change Your Name In Nc Pdf Eforms

Official Ncdmv Pay Property Tax On Limited Registration Plates

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Northampton County Tax Department

Tax Administration Duplin County Nc Duplin County Nc

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners